Whether you’re a medical care provider, a durable medical equipment distributor or your office provides other specialized medical services such as orthodontia or cosmetic procedures, one thing is certain: your patients rely on you. They trust you to provide them with effective services and products that will improve not only their health but their quality of life as well.

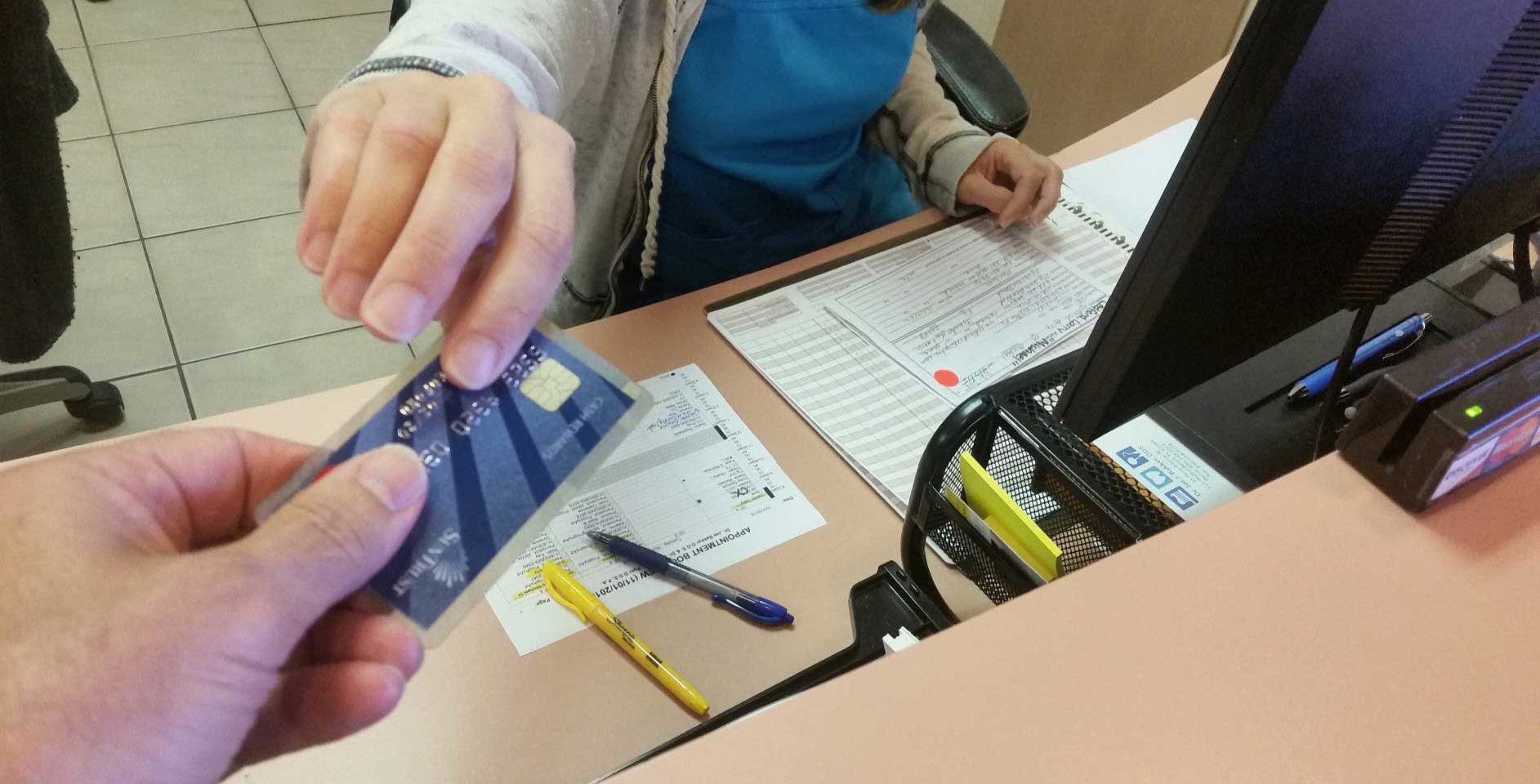

And as their provider, you’re tasked with the unique responsibility of providing accessible care. That’s where consumer financing comes into play. By offering consumer financing, you enable everyone who walks through your doors to receive the care they need regardless of their ability to pay a large balance upfront. Consumer financing can significantly improve your patients’ experiences as they come to you for care. Below, we’ll explain how!

1. Remove the Stress of Upfront Payments

Paying for medical care should never be a stressor for patients. Seeking out care requires physical and mental and even emotional energy. By the time a patient needs to pay for those services, you want to ensure making payments doesn’t cause more stress or anxiety.

Unfortunately, without medical financing, many patients don’t have the opportunity to receive the medical services and equipment they need. In fact, a recent study showed one out of every three patients would postpone care if their provider didn’t offer financing. By providing consumer financing to your patients, you remove the stress of upfront payments which, for some, are impossible to make.

Consumer financing enables your patients to choose the services they want and need. They don’t have to wait months, years, or even deny care altogether due to a lack of funding. Professional financing firms like United Consumer Financial Services take the stress out of paying for medical services with simple, affordable monthly payments that most anyone can make.

2. Automate Patient Payments

When your patients undergo medical care or purchase medical equipment from you, they’re likely balancing a lot of things on their plate. As the provider, you can make payment as easy as possible with an automatic payment plan.

By offering automatic payments, your patients never have to worry about forgetting a bill. United Consumer Financial Services offers autopay for your patients and customers. They simply input their banking information, and UCFS’s system ensures their payments on time every month.

With this automation, your patients will never stress about forgetting a payment. They can spend their energies focused elsewhere while the team at UCFS takes care of their monthly transactions. Automatic payments are one of the best ways to give your patients a great experience with your offices.

3. Provide Patients with Helpful Customer Service

Regardless of the service or products you provide, your patients will likely have questions regarding their payments. That’s why it’s important to provide your patients with immediate and accessible customer service regarding their bills, payments, and accounts.

United Consumer Financial Services boasts a team of dedicated, knowledgeable, and helpful customer service representatives based in Cleveland, Ohio. In an age where the healthcare industry is facing a consumer confidence crisis, giving your patients access to a customer care team who prioritizes their needs and concerns will earn their trust.

In addition to cultivating a positive client relationship with your office, UCFS’s customer service saves you time and resources. They take care of all payment communication, freeing up your office to focus on customer care and service excellence. Choosing consumer financing with a friendly, helpful customer service team benefits both you and your patients.

4. Empower Patients to Set Their Own Payment Schedule

Patients want and often need flexible payment options. Consumer financing allows them to set their own payment schedule: the number of months with the payment amount that fits their budget. This gives them confidence that they can afford your products and services without compromising their current budget or savings.

As a medical provider or DME distributor, you know that patients put a great deal of trust in you and your team. They look to you to provide the care they need, and they also look to you to provide services they can afford. Consumer financing makes predictable, affordable payment possible.

At UCFS, your customers enjoy fixed, low monthly payments based on a timeline that works for their needs. Without financing, patients must bear the burden of paying for their entire bill upfront. And for most people seeking medical care, upfront payment isn’t an option.

But when patients can choose flexible payment plans, you grant them access to the medical care they need—and deserve.

5. Provide Clear Plans and Transparency from the Start

Seeking out medical services can be intimidating for patients. And the payment process is often even more overwhelming. In fact, 75 percent of all patients look up the cost of their medical expenses online before pursuing care. And nearly half of all patients say having clear expectations of their out-of-pocket costs played a significant role in their choosing a provider.

Offering consumer financing gives your patients the peace of mind that they can easily afford your services or products. And by advertising that you offer financing, patients are more likely to choose you over another provider.

Because medical equipment, services, and procedures are large-ticket items, patients seek out offices that offer consumer financing. When a patient knows you offer financing and provide an easy way for them to afford the care they need, they’re likely to choose you over other offices that offer the same services but don’t have financing options. Consumer financing allows you to offer clear payment options to your patients, so they can have accurate expectations of their expenses.

Conclusion

As a medical business or provider, you hold your patients’ well-being in the palm of your hands. We know you want to do everything in your power to ensure they have a great experience from the moment they walk into your office.

As you can see, offering consumer financing improves the patient experience from start to finish. United Consumer Financial Services consumer financing gives your patients the confidence that they can afford the care they need while reducing the stress and burden of paying in full.

Consumer financing empowers your patients while building a trusting, long-term relationship with your company that will benefit you both. Contact the friendly team at United Consumer Financial Services today to learn about consumer financing and how it will positively transform the patient experience.